Business Development Director

- Developing new relationships and new solutions

- Empowered leadership position

- Performance-driven compensation

Send your resume to:

Careers@cred-iq.com

Opportunity Description

Business Development Director Location: Remote US

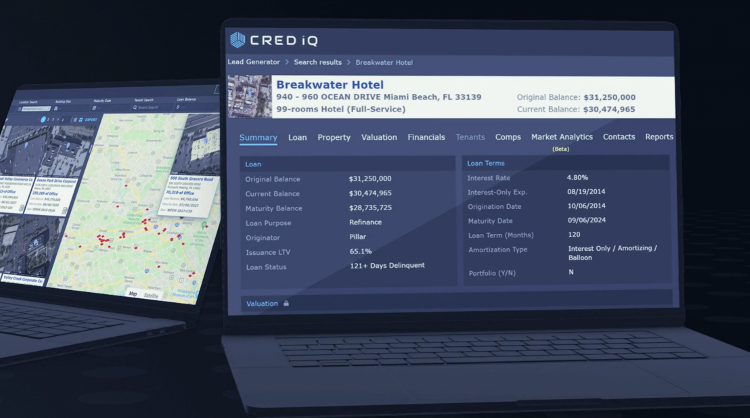

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Launched in 2020, the platform was developed with leading-edge technologies, and delivers real-time commercial real estate data through a user-friendly interface. Subscribers to CRED iQ use the platform to identify opportunities for leasing, refinancing, mezzanine lending, distressed debt, and acquisition.

We are actively seeking a Senior Sales Representative with 5-10 years of experience to help expand our client base. The successful candidate must have a proven track record of exceeding sales goals in a business-to-business (B2B) environment. You will be responsible for selling multiple CRED iQ products to a variety of commercial real estate, financial services and banking clients including: Brokers, Commercial Lenders, Loan Servicers, Distressed Debt Investors, Insurance Companies, Money Managers, Real Estate Developers, Real Estate Owners/Investors, Appraisers and Technology Platforms. Our compensation plan is generous and includes commission for the life of account.

Responsibilities

• Schedule and lead CRED iQ product demonstrations

• Establish and cultivate relationships

• Develop a deep understanding of the business, challenges, objectives and use cases

• Manage a sales pipeline, produce monthly forecasts and track all activity within our CRM

• Participate in marketing and business planning to identify growth opportunities

• Collaborate with CRED iQ Product and Engineering teams to ensure total client satisfaction

Requirements

• 5 – 10 Years of Enterprise / SaaS Sales experience

• Proven track record of exceeding sales goals

• Startup experience (preferred)

• Commercial Real Estate, CMBS, Data and/or Technology experience (preferred)

• Strong communication skills, verbal and written

• Business travel required

• Bachelor’s degree in Business or Finance is preferred

Benefits

• Competitive Base Salary

• Commission (new and renewal)

• Equity Options

• Home Office Expense Reimbursement

• Flexible Work Schedule / Remote Work

CRED iQ is an equal opportunity employer and fintech startup that thrives in a fast-paced dynamic environment. Candidates who are self-motivated professionals, eager to help grow a burgeoning business will succeed in this role. If you would like to apply or learn more about this opportunity, please contact us at careers@cred-iq.com.

Send your resume to careers@cred-iq.com

The Platform of the Future

CRED iQ is powered by trillions of dollars of commercial mortgage data that is updated in real-time every month.

>CREFC Monthly Data Updates (Loan, Property, Financial, Watchlist, Delinquent, REO, Loan-Level Reserves, and Bond Reports)

>Supplemented by Prospectus, Annex-A, Subordinate Debt, Mezzanine, Pari Passu Debt Structures

>All data updated on User Interface with Mapping & Geocodes

>Full History dating back to the mid-1990's.

CRED iQ's Unique Offering

Powerful Combination of CMBS & Securitized Loan Information with Proprietary Tools and Datasets

- Accurate & Verified Historical CMBS Default Data since the mid-1990's

- Loan Statuses, Special Servicer Transfers, Actual Realized Loss Amounts

- Valuation Software "MyQ" - Discounted Cash Flow Analysis & Direct Cap Valuations

- Comps (Sales, Loan, Rent, Line Item Expense, Cap Rate, and Appraisal Comps

Default Data

Easily quantify loss assumptions and risk modeling by property type, market, original underwriting, and key default statistics to run accurate and supportable models.

Valuation

Run accurate and supportable valuations with a streamlined DCF model that is pre-filled with market assumptions. Adjust variables and derive your own values with MyQ.

Comps

Pull and download verified comp data. All properties include financials, appraised values, loan data, cap rates, and detailed financial line items. Streamline your underwriting with CRED iQ Comps.