Powering CRE & CMBS Risk Models

Proven data strategies and valuable insights for Commercial Real Estate Lenders & Banking Executives

Request More Information

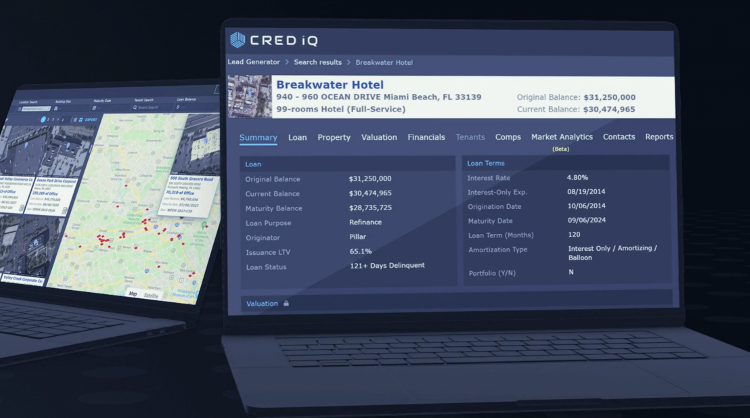

Detailed Loan, Property, Financial, Valuation, Default & Realized Loss Data

CRED iQ's Data Platform Includes all present & historical available data across the various CRE Financing types:

> CMBS

> CRE CLO / Floating Rate Deals

> Single Asset / Single Borrower

> Multifamily GSE/Agency

Full Data Access of the Securitized Loan Universe

CRED iQ is powered by trillions of dollars of commercial mortgage data that is updated in real-time every month.

>CREFC Monthly Data Updates (Loan, Property, Financial, Watchlist, Delinquent, REO, Loan-Level Reserves, and Bond Reports)

>Supplemented by Prospectus, Annex-A, Subordinate Debt, Mezzanine, Pari Passu Debt Structures

>All data updated on User Interface with Mapping & Geocodes

>Full History dating back to the mid-1990's.

CRED iQ's Unique Offering

Powerful Combination of CMBS & Securitized Loan Information with Proprietary Tools and Datasets

- Accurate & Verified Historical CMBS Default Data since the mid-1990's

- Loan Statuses, Special Servicer Transfers, Actual Realized Loss Amounts

- Valuation Software "MyQ" - Discounted Cash Flow Analysis & Direct Cap Valuations

- Comps (Sales, Loan, Rent, Line Item Expense, Cap Rate, and Appraisal Comps

Default Data

Easily quantify loss assumptions and risk modeling by property type, market, original underwriting, and key default statistics to run accurate and supportable models.

Valuation

Run accurate and supportable valuations with a streamlined DCF model that is pre-filled with market assumptions. Adjust variables and derive your own values with MyQ.

Comps

Pull and download verified comp data. All properties include financials, appraised values, loan data, cap rates, and detailed financial line items. Streamline your underwriting with CRED iQ Comps.

Speak with our CRE Risk Modeling Team