Get the Most Trusted CRE & CMBS Data with CRED iQ

✅ $2.3 trillion of CRE & CMBS property and loan data

✅ Borrower & ownership contact information

✅ Real-time alerts of distress & off-market deals

Get More with your CMBS Data Subscription

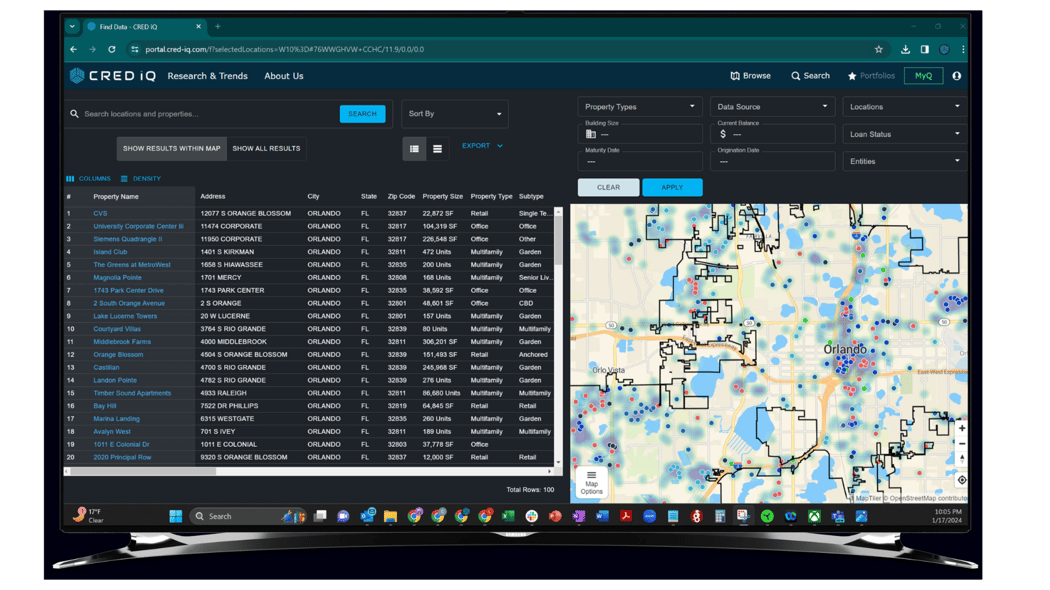

Precise CRE & CMBS Data

Full coverage of the securitized market. Every market, every property type, every opportunity.

Cost & Workflow Breakthroughs

Save time, save money, create more deals faster.

Real-time Data & Alerts

Daily alerts highlighting the earliest signs of distress on any property.

True Owner & Borrower Data

Engage the principals immediately! Leverage the most accurate data in the industry. Names, emails, cell phones, addresses, and more.

Income & Expense Statements

Underwrite with confidence and ease using audited operating statements. Occupancy, lease expirations, and rollover included too.

Integrated Valuation and Refi Tools

Instantly value CRE assets and stress test loans. Dial in valuations and refi scenarios in minutes, not weeks.

"The only platform with accurate borrower contact info"

-Partner, Debt & Equity Advisory

"CRED iQ's data is essential for our team."

Executive Director, Top 5 Bank

"The best user-interface in the game"

Managing Director, Top CRE Brokerage

Start your Free Trial of CRED iQ Today

Enjoy full access:

💠 $2.3 trillion of CRE & CMBS loan data

💠 Coverage of over 150 million properties

💠 Loan balances, terms, maturity dates, and more

💠 Borrowers, owners, lenders, and special servicers

💠 Income & expense operating statements

💠 Building, tenant, and lease data

💠 Integrated valuation & refinance models

💠 Historical data from 1995 to present day

💠 Audited data from trustees & servicers

💠 Plus much more...

Trial Sign Up Form

About Us

CRED iQ is a commercial real estate data & analytics platform used by investors, lenders, brokers, and other CRE finance professionals. The easy-to-use interface is fully equipped with official loan and financial data. The platform is supplemented with true borrower and ownership contact information, valuation software, and refinance models.

As an official market data provider, CRED iQ’s is powered by over $2.3 trillion of audited loan and transaction data that includes all property types and geographies. CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition & lending opportunities, market analysis, underwriting, and risk management.